I need some help understanding a note given in a lot of papers I've read.

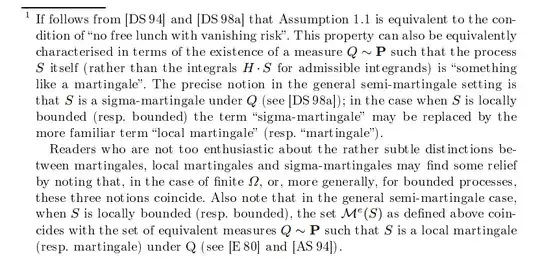

Let $(\Omega,\mathcal{F},P)$ be a complete probability Space, $\mathbb{F} = (\mathcal{F}_t)_{t\in[0,T]}$ a given filtration with usual conditions, $S$ be a locally bounded semi-martingale and $$M_a = \{ Q \ll P \; | \; S \text{ is a locale } (Q,\mathbb{F})-\text{martingale}\}$$ the set of all absolutely continuous martingale measures.

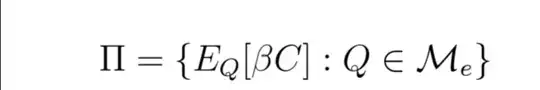

Now I found a lot of papers claiming it's natural to assume that the set $$M_e = \{ Q \in M_a \; | \; H[Q|P] < +\infty \}$$

is non empty where

$$H[Q|P] = \begin{cases} E_P\Big[\frac{dQ}{dP}\log\frac{dQ}{dP}\Big] & \mbox{ if }Q \ll P \\ +\infty & \mbox{ otherwise} \end{cases} $$

is the relative entropy of $Q$ w.r.t $P$.

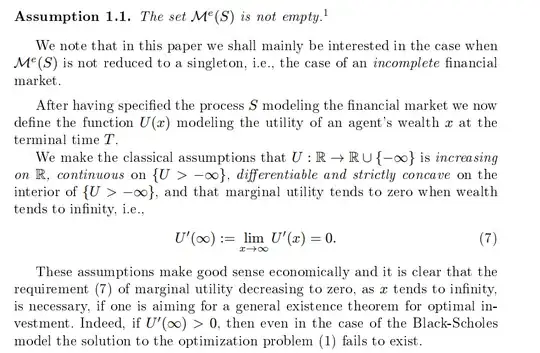

But I see no reason why $M_e \not= \emptyset$ should hold.

Maybe someone has a hint or link for me.

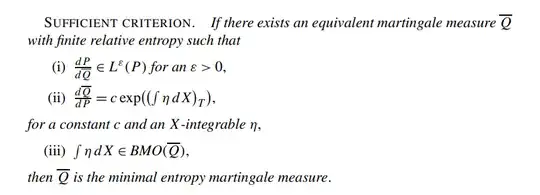

edit 09.12.2019: To point out my main issue here (see comments to second answer): It's totally clear to me why the set $M_a$ of absolutely continuous (locale) martingale measures is not empty if we have an arbitrage free (in the NFLVR sense) market. But why does at least one of these measures have a finite entropy related to our initial measure $P$?

Greetings